Accurate medical billing requires understanding the difference between CPT and HCPCS codes. These code sets work together to describe every service, procedure, and supply used in patient care. Mistakes in choosing between CPT vs HCPCS codes lead to denials, delays, and compliance risks.

This guide explains CPT vs HCPCS, their main differences, how they are structured, and when each code type should be used.

Understanding CPT Codes

Current Procedural Terminology (CPT) codes are maintained by the American Medical Association. They describe medical, surgical, and diagnostic services performed by healthcare providers. These codes are used for billing private insurance, Medicare, Medicaid, and workers’ compensation.

CPT codes are divided into three categories:

Category I CPT Codes

These codes describe commonly performed, medically necessary services. Examples include office visits, imaging tests, surgeries, and lab procedures.

Category II CPT Codes

These are optional performance measurement codes used for quality reporting.

Category III CPT Codes

These codes describe emerging or experimental services and technologies.

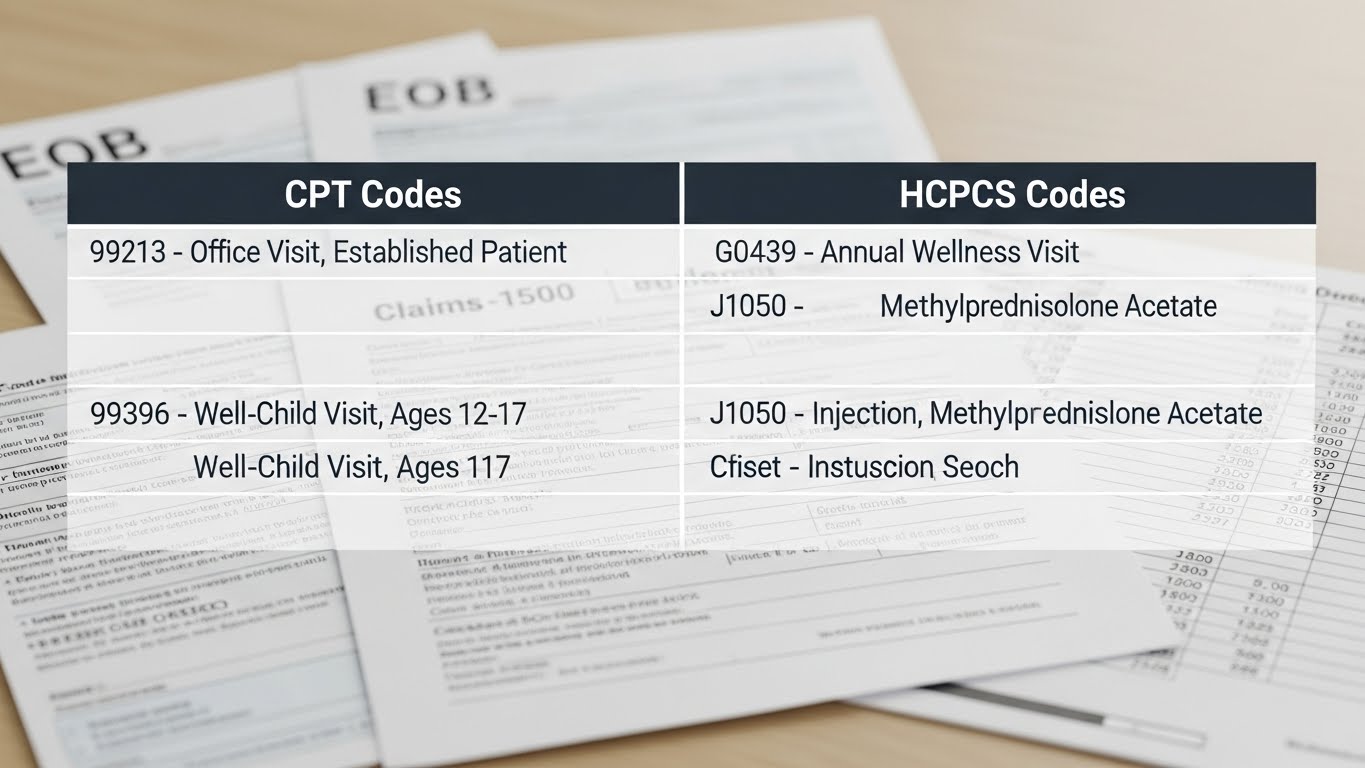

CPT codes are numeric, typically five digits (e.g., 99213, 71045).

Understanding HCPCS Codes

Healthcare Common Procedure Coding System (HCPCS) codes are used to bill Medicare and other payers for supplies, equipment, drugs, and non-physician services. They supplement CPT codes.

HCPCS has two levels:

HCPCS Level I (CPT Codes)

This level is identical to CPT codes.

HCPCS Level II Codes

These alphanumeric codes describe:

• Medical supplies

• Orthotics and prosthetics

• Ambulance services

• Durable medical equipment (DME)

• Injectable drugs

• Other non-physician services

Examples include A0425 (ground mileage) or E0110 (crutches).

CPT vs HCPCS: Key Differences

While both code sets describe healthcare services, they serve different purposes.

Type of Service

CPT

Describes physician services and procedures.

HCPCS

Describes supplies, equipment, and non-physician services.

Format

CPT

Numeric, five digits.

HCPCS

Alphanumeric, starting with a letter followed by four numbers.

Payer Requirements

CPT

Used by all payers.

HCPCS

Primarily required by Medicare and Medicaid.

When to Use CPT vs HCPCS Codes

Choosing the right code depends on the type of service provided.

Use CPT Codes When Billing For

• Office visits

• Surgeries

• Diagnostic imaging

• Lab tests

• Injections and procedures

• E/M services

These codes reflect provider-performed medical services.

Use HCPCS Codes When Billing For

• Supplies used during treatment

• Ambulance transportation

• DME (wheelchairs, walkers, crutches)

• Injectable medications

• Prosthetics

• Braces, splints, wound care supplies

If Medicare requires a HCPCS Level II code, CPT cannot substitute.

Why CPT vs HCPCS Confusion Leads to Denials

Using CPT instead of HCPCS—or vice versa—creates issues such as:

• Missing supply charges

• Billing the wrong service type

• Claim edits triggered by incorrect code pairings

• Medicare denials for improper coding

Reviewing NCCI edits and payer-specific policies helps avoid these errors.

Final Thoughts

Understanding CPT vs HCPCS is essential for precise medical billing. CPT codes describe physician services, while HCPCS codes describe supplies, equipment, and non-physician services. Using the right code set increases clean claim rates, strengthens documentation, and ensures proper reimbursement across Medicare and commercial payers.